Many assume accumulating wealth solves everything, but managing that wealth often becomes the real challenge. Recent industry reports show that over 50% of high-net-worth individuals lack a proactive financial planning strategy, exposing them to unnecessary risk. To overcome this, you need high net worth financial planning tips that show how to work with a financial advisor, deploy investment strategies, and customize a comprehensive financial plan. This article provides a full guide to addressing unique challenges, balancing goals and risk tolerance, and securing your financial future.

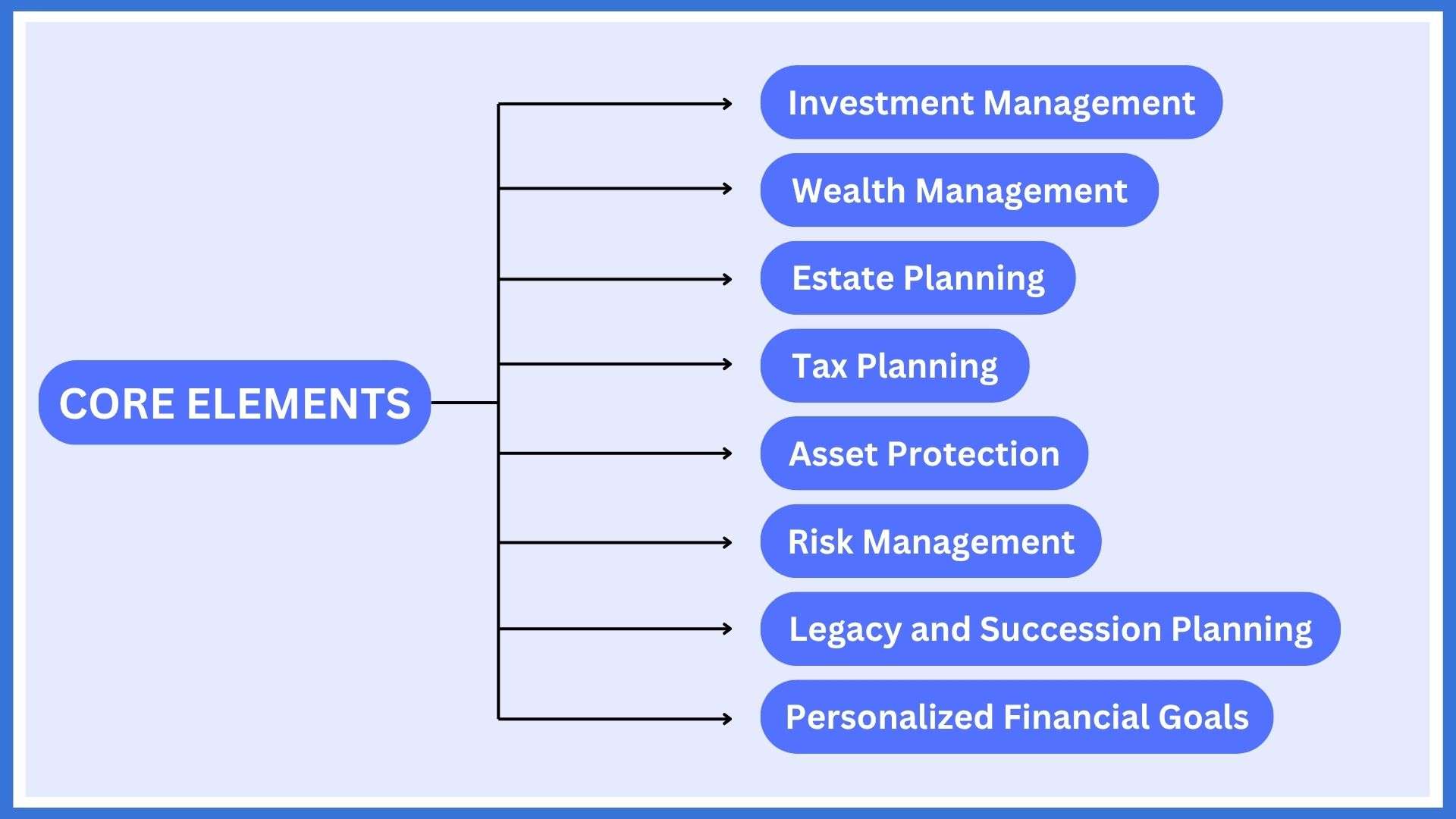

Core Elements of High Net Worth Financial Planning

High-net-worth financial planning focuses on personalized strategies to preserve, grow, and transfer significant wealth effectively. A comprehensive financial plan must address both personal and business-related financial needs for individuals and families with complex financial structures. The following are the core elements of this process:

Who Qualifies as High Net Worth in the U.S.?

A high-net-worth individual (HNWI) is someone with substantial investable assets, excluding their primary residence. Those with greater financial capacity fall into the ultra-high-net-worth (UHNWI) category. These classifications help financial advisors and wealth management firms create strategies suited to complex financial needs.

- High-Net-Worth Individual (HNWI): $1 million or more in investable assets

- Ultra-High-Net-Worth Individual (UHNWI): $30 million or more in investable assets

High Net Worth Financial Planning Tips

Create a Tailored Financial Plan:

Work with a financial advisor to design a customized financial plan that reflects your unique needs. It should clearly define financial goals, investment strategies, and short-term liquidity options to sustain your financial well-being.

Diversify Your Investment Portfolio:

Spread your wealth across various asset classes to minimize volatility and enhance returns. A well-diversified investment portfolio ensures stability even during uncertain economic conditions, thereby supporting consistent wealth management outcomes.

Prioritize Tax Planning Early:

Effective tax planning reduces your tax liability and increases savings potential. Utilize trusts, tax-deferred accounts, and investment products with inherent tax benefits to preserve your wealth efficiently.

Implement Asset Protection Measures:

Establish legal structures that protect your assets from potential claims. Techniques like insurance layering, asset titling, and liability diversification are essential for long-term wealth preservation.

Focus on Estate and Legacy Planning:

Develop a estate plan to ensure smooth wealth transfer to future generations. Incorporate succession planning to maintain family control, reduce disputes, and uphold generational continuity.

Work with a Financial Advisor You Trust:

Partnering with the right financial advisor or wealth management firm allows you to make informed decisions. Their management services help align your financial affairs with strategic goals and market opportunities.

Review and Adjust Regularly:

Monitor your financial performance periodically. Investment opportunities evolve, and adjusting strategies accordingly ensures your significant wealth remains optimized over time.

How Financial Advisors Customize Wealth Strategies

A skilled financial advisor evaluates every high-net-worth individual’s income sources, investment opportunities, and financial goals to build a tailored strategy. They coordinate investment management, asset protection, and tax planning approaches to meet short-term liquidity and long-term growth requirements. Additionally, advisors assess business owners’ succession concerns and wealth transfer priorities to ensure smooth transitions.

By collaborating closely, they design investment portfolios that align with lifestyle, risk management, and generational priorities. Consequently, clients benefit from customized solutions that safeguard assets, deliver returns, and secure enduring financial well-being for individuals and families alike.

Why a Financial Advisor Matters for High Net Worth Individuals:

A professional financial advisor offers strategic insight for high-net-worth individuals seeking comprehensive wealth management solutions. They coordinate investments, tax planning, and estate structures to maintain stability and growth. Hence, clients benefit from objective advice that supports informed decisions and enhances long-term financial well-being across diverse financial affairs.

Choosing the Right High-Net-Worth Financial Planning Advisor:

Selecting the right financial advisor requires reviewing experience, credentials, and approach toward high-net-worth financial planning. Choose one who understands complex financial structures and provides transparent management services. Moreover, ensure their philosophy aligns with your financial goals, risk tolerance, and commitment to wealth preservation for future generations.

Investment and Wealth Management Strategies

- Develop a Comprehensive Financial Plan: A qualified financial planner can help design a comprehensive financial plan that aligns investment goals with financial objectives, risk appetite, and long-term vision for financial success.

- Adopt Diversified High-Net-Worth Investment Approaches: Implement strategies for high-net-worth individuals that include global diversification, private equity, real estate investments, and trading affiliate opportunities.

- Leverage a Trusted Advisor’s Expertise: A trusted advisor or wealth management team provides informed financial advice, helping you make confident investment decisions aligned with your financial picture and market conditions.

- Focus on Tax Optimization Strategies: Effective tax optimization strategies can reduce your tax burden significantly. Understanding complex tax laws helps ensure compliance while enhancing after-tax income growth.

- Plan for High-Net-Worth Retirement: High-net-worth retirement planning focuses on sustaining income streams, preserving capital, and maintaining financial freedom through structured asset allocation.

Asset Protection and Risk Mitigation

Effective asset management requires balancing growth with protection to ensure long-term financial security. A high-net-worth financial advisor implements financial planning strategies that shield wealth against market downturns and legal liabilities. Financial planning for high net worth individuals includes insurance coverage, trust structures, and asset diversification. Managing your wealth effectively through these measures safeguards your family’s financial well-being and ensures stability even during economic fluctuations, thereby preserving both current and future prosperity.

Integrating Wealth Planning with Lifestyle Goals

Comprehensive wealth planning connects financial strategies with personal aspirations to maintain a fulfilling lifestyle. A financial advisor can help design a customized plan that aligns lifestyle choices with financial goals. Balancing financial freedom and personal values ensures a secure financial future. Finding the right financial expert is essential because they understand your unique challenges and tailor strategies that sustain your family’s financial stability. Consequently, wealth planning becomes both purposeful and sustainable across generations.

FAQs

1. Can a financial planner help with succession planning?

Yes, they develop legacy planning to ensure smooth wealth transfer.

2. What benefits come from using multiple asset classes?

Diversification mitigates risk and enhances return across changing market cycles.

3. Do UHNWIs need different strategies?

Absolutely, they face deeper complex tax laws, larger portfolios, and more legacy issues.

4. How often should I review my financial plan?

At least annually, or when your goals and objectives evolve.

5. How to find the right financial advisor?

Look for experience with high-net-worth individuals, trustworthiness, and alignment with your values.